There is a secret ingredient to successful investing. This is a secret used by renowned investors like Jack Bogle and Warren Buffett, and it’s a secret that you can have access to too.

But rather than telling you what it is, I’m going to share two hypothetical scenarios to illustrate what this secret is. Put on your thinking caps!

Ready?

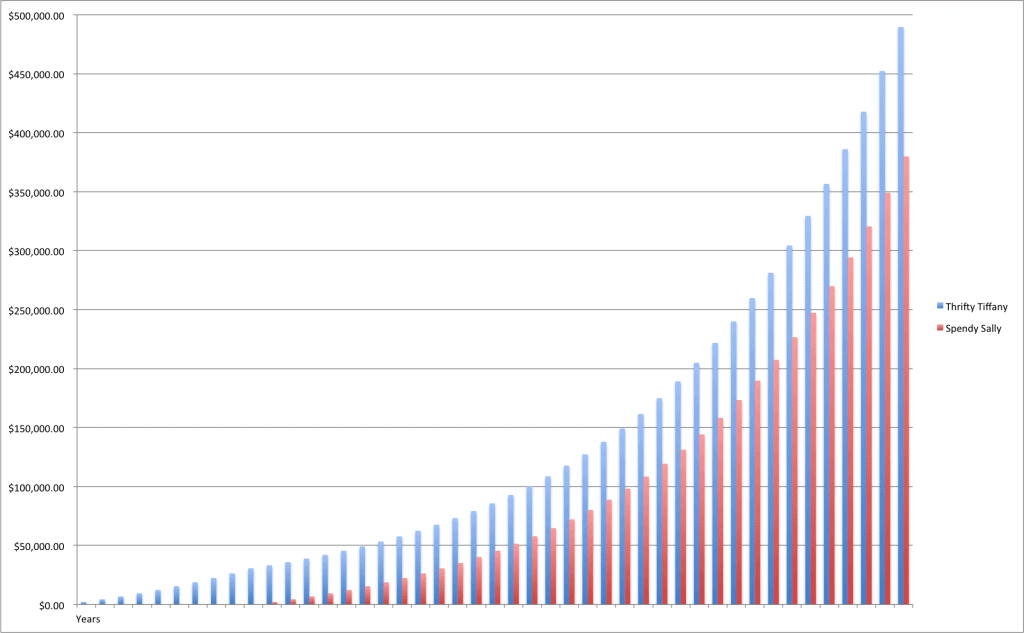

Illustration 1: Thrifty Tiffany & Spendy Sally

Thrifty Tiffany started investing at age 20, putting in $2000/year until age 30, at which time she stopped adding another dime. So she invested a total of $20,000 of her own money in the course of those ten years, and left that amount alone to grow until she retired. Assuming an annualized return of 8%, when she looked at that account again at age 65, she will find it to have grown to nearly $500,000. So the $20,000 has grown to become half a million. That’s a 25-time increase!

Spendy Sally, on the other hand, delayed investing until she was 30, then she invested $2000/year every year (the same amount as Thrifty Tiffany) until she retired at 65 (35 years as opposed to Thrifty Tiffany’s 10 years). With the same 8% rate, at retirement she would have put in $70,000 of her own money (compared to Thrifty Tiffany’s $20,000) but it would have grown to only $380,000. That’s an increase of only around 5-times. How could she put in so much more than Thrifty Tiffany but yet get so much less?

What’s the secret?

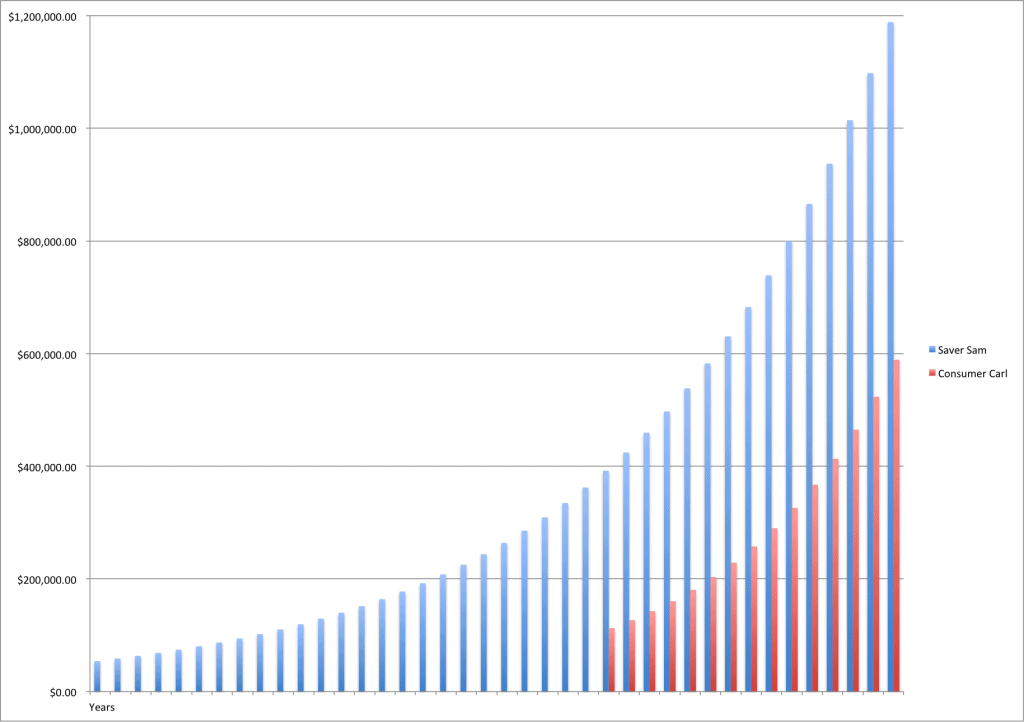

Illustration 2: Saver Sam & Consumer Carl

At age 25, Saver Sam married the woman of his dreams who also happened to be a Mrs. Crumb Saver. The two of them decided to live on his salary alone and invest all of the money they got as gifts from their wedding AND her entire year’s salary, which totaled $50,000. She stopped working after that first year and became a stay-at-home mom, and they never added another cent to those investments. With an 8% rate of return, 40 years later when Saver Sam turns 65, that $50,000 has become nearly $1.2 million!

Consumer Carl and his wife thought that they would be better off enjoying life first then start investing later with more capital and higher rates (assuming they can predict such things). So when they turned 50, they invested a lump sum of $100,000, not to be touched until age 65. They hit an incredible stretch in the stock market and got an annualized return of 12% for those 15 years. When they’re ready to retire, their nest egg has only grown to be slightly under $600,000. That’s HALF of Saver Sam, even with TWICE as much starting capital and a significantly higher rate of return!

Why the huge discrepancy in numbers? What’s the secret?

The Secret Ingredient

The two most noticeable ingredients (or variables) in the investing illustrations above were 1) the amount of money invested and 2) the interest rate. The first illustration demonstrated that even with the same 8% rate for all parties, the dollar amounts invested did not determine who ended up with more. The individual who invested LESS actually ended up with MORE. In the second illustration, the one who started with less money AND lower interest rates STILL came out on top. How can this be?

The answer is all in the secret ingredient of investing: TIME.

Slow Cooker vs. Microwave

A really smart guy once said:

Compound interest is the eighth wonder of the world. He who understands it, earns it…he who doesn’t…pays it. – Albert Einstein

The power of compound interest is the bedrock that underlies what investing is all about. As we learned in high school algebra, it is the power of earning interest on the principal plus all subsequent interest. This is in contrast to simple interest where interest is only ever earned on the initial principal. Here’s a simple graph to illustrate the difference:

Most people want a microwave solution to their investments: Put up the initial capital, press the magic button, sophisticated investments zap that money with super high rates, and “ding!” we get a steaming pile of money. But as that graph above shows, the magic of compounding interest works better the more time it has. So investing is really more like a slow cooker, nice and easy without the high-risk electromagnetic waves of exotic investment instruments and techniques, letting the flavors compound by simmering for a long time in the juices of a steady rate of return.**

The real secret is not the sophistication of your investment strategy or getting caught up in the euphoria of the latest hot fad. It’s simply starting early and giving plenty of time for compound interest to do its thing. This is why Thrifty Tiffany and Saver Sam handily outdid their counterparts over the long haul. And this is why Warren Buffett once said this:

Our favorite holding period is forever.

The Oracle of Omaha knows what secret ingredient to add to his investment stew.

The Takeaways

So let’s get practical. What can we learn?

- Invest as early as you can. – As illustrated above, you’ll do better putting in a little bit early than putting in a lot later. The best time to start investing was a long time ago, the next best time is right NOW.

- Yields aren’t everything. – Beware of chasing higher yields to “speed up” your investment growth at the expense of high risk. A long time horizon with a steady rate of return is much better than betting the house on a super high potential return that also might send you to live in a dog house.

- Be patient. – Investing is for the long haul. It’s not a sprint, it’s a marathon—and the last I remembered; the tortoise beat the hare at that race. So don’t worry if your investments aren’t growing as fast as you’d like right now, persevere and keep your eyes down the horizon at the finish line down the road.

- Slow cookers are nice. – They don’t emit harmful radiation, they rarely burn your food, and they won’t explode if you put metal in it. Available at a local thrift store near you.

* Check out this compound interest calculator to play with your own numbers to see how things shake out for you.

** It IS possible, however, to MASSIVELY speed up the rate of wealth accumulation by simply living on less and saving more. Not convinced? Check out this previous post: A New Definition of “Rich”, and a Simple Formula to Get There.