Banks. People love to hate them, but we all know that we need them. Since banking is essential to live in this day and age, why not seek out a better banking experience? For me, the answer is online banking.

The two online banks I currently use are Ally Bank and Capital One 360 (formerly ING Direct). In this post I’ll be discussing virtues of online banking that apply to both institutions, and perhaps in a future post I’ll compare/contrast the two of them in more detail. Suffice it to say that I have had good experiences with both banks and would recommend them both to those who are interested.

No More Brick and Mortar

By doing away with brick and mortar locations all together, these banks have much lower overhead and the results are better rates and services for you. But that raises the biggest concern for online banks: “What about the services that I need a physical location for?” Here’s how they accommodate some of those key needs:

- Cash withdrawal – With Ally, you can use any ATM from any other bank and they will refund you the ATM fee. Capital One 360 offers a huge network of ATMs that you can use for free. In either case, you are well covered.

- Check deposit – You can mail in the check, scan and deposit via the website, or snap a photo to deposit with your smartphone/tablet mobile app.

- Cashier’s check – The bank will mail one to you, usually at no charge. Since for most people this is a rare occurrence, the delay shouldn’t be a huge issue. Capital One 360 will even send it overnight.

The only service that an online bank can’t provide is the depositing of cash. For that, you’ll need to exercise some creativity and call on the help of some friends. For Deb and me, we so seldom need to deposit cash that it has hardly ever been a problem.

Big, Big Benefits

Here are some of the biggest benefits of online banks, Ally Bank and Capital One 360 in particular:

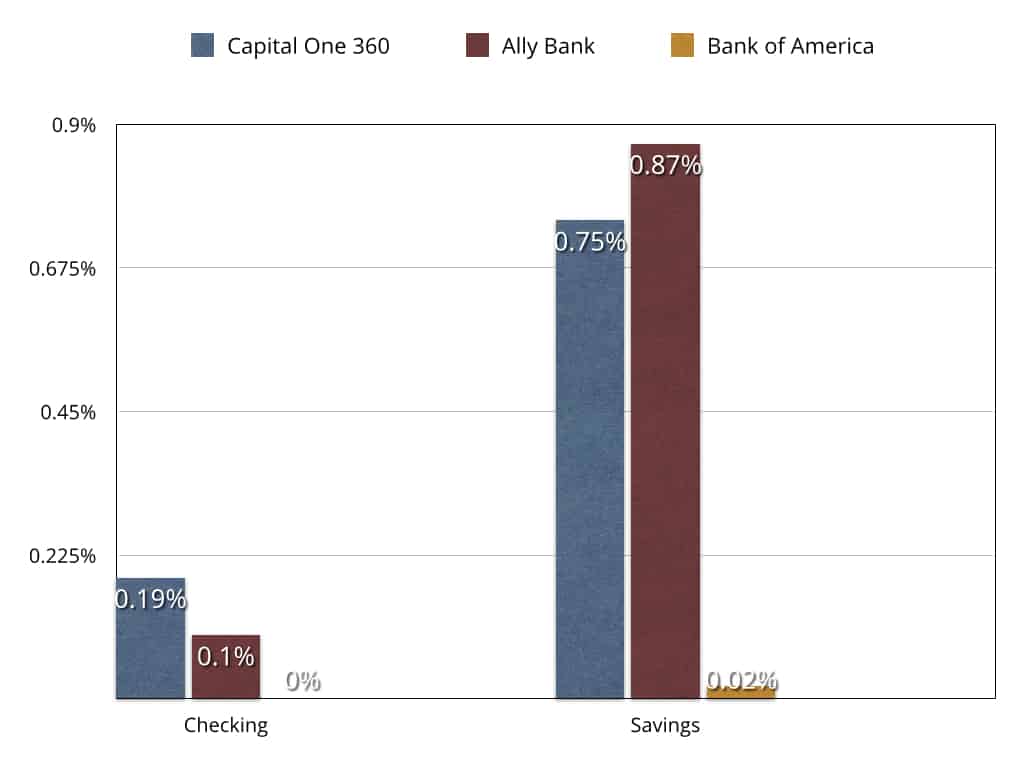

1. Higher Interest Savings Account and CDs. At the time of this writing, savings accounts for Ally and Capital One 360 are yielding 0.87% and 0.75% respectively as opposed to 0.02% for Bank of America. CD rates tell a similar story.

2. Interest Checking Accounts. Yes, you also get interest from their checking accounts too! As of right now, Ally’s checking is 0.10%* while Capital One 360’s checking is 0.19%. In case you didn’t catch it, these banks’ CHECKING accounts have higher interest than BofA’s SAVINGS account.

I know these fractions of percents are still paltry, but consider for a moment how they stack up relative to each other with this graph:

BofA’s numbers don’t even register on the map! Put it this way, suppose you have $10,000 in savings; with BofA you’ll get $2/year, Capital One 360 will get you $75/year, while Ally will get you $87/year. It’s a sizable difference.

So why stay with a big bank that pays you no interest AND slaps a fee on you if you go below the minimum balance? Speaking of which…

3. No Minimums, No Maintenance Fees, No Hidden Gotchas. I used to feel that the banks were always looking for ways to nickel ‘n dime me to death with new fees. With my online banks now, I never worry about unknown fees jumping out of nowhere to take a bite out of my hard earned Crumb-stash. Everything is straightforward, as it should be.

4. Free Debit Cards & Free Checks. I use my reward credit card for most everything these days, but for our excursions to ALDI I turn to my trusty Ally Bank debit card. The Capital One 360 debit card even has no foreign transaction fees! And who doesn’t love getting free checks?

5. Awesome Customer Service. Ally has 24/7 telephone customer service, which I have used on countless occasions. You go straight to a US-based human (you don’t even need to navigate a phone menu that’s 12 layers deep!) who is always very professional and superb. I have never had an instance yet where they flubbed or couldn’t help me. I haven’t called Capital One 360’s customer service as much, but the few times that I have, I had an excellent experience as well. In both cases, I actually felt respected and valued as a customer and it’s developed my loyalty for both banks.

6. Convenience. As their names suggest, these banks try to stay on the cutting edge of internet technology. That means they’re always updating their websites and mobile apps with better, easier, and faster ways to manage your finances. Even ways to help make transferring money to other people easier, safer, and cheaper than before.

Ready for a New Banking Experience?

Are you curious? The best part is, it costs you nothing to give it a try. The only issue to be aware of is that you will need an existing bank in order to make your initial deposit into your account. After that, you may never need to step foot into a physical bank again.

*Ally actually currently offers a 0.60% APY interest checking account for balances of $15,000 or more, but we’re using the lower number just to be a bit more conservative in our comparisons.